Planning for the future is one of the most valuable steps you can take to protect your loved ones and secure your legacy. An essential part of this process is understanding the tools available for managing and distributing your assets—namely, wills and trusts. Each of these options serves different purposes and offers distinct advantages, depending on your specific goals and family needs. Here, we’ll explore the unique benefits of wills and trusts, providing you with insights to make informed decisions about safeguarding your assets and ensuring your family’s future is well-protected.

Understanding Wills and Trusts: Key Differences and Benefits

Both wills and trusts are foundational estate planning tools, yet they offer different advantages based on your goals and circumstances. In this guide, we’ll outline the purpose and features of each, helping you decide which is best suited to protect your family and preserve your legacy.

What is a Will?

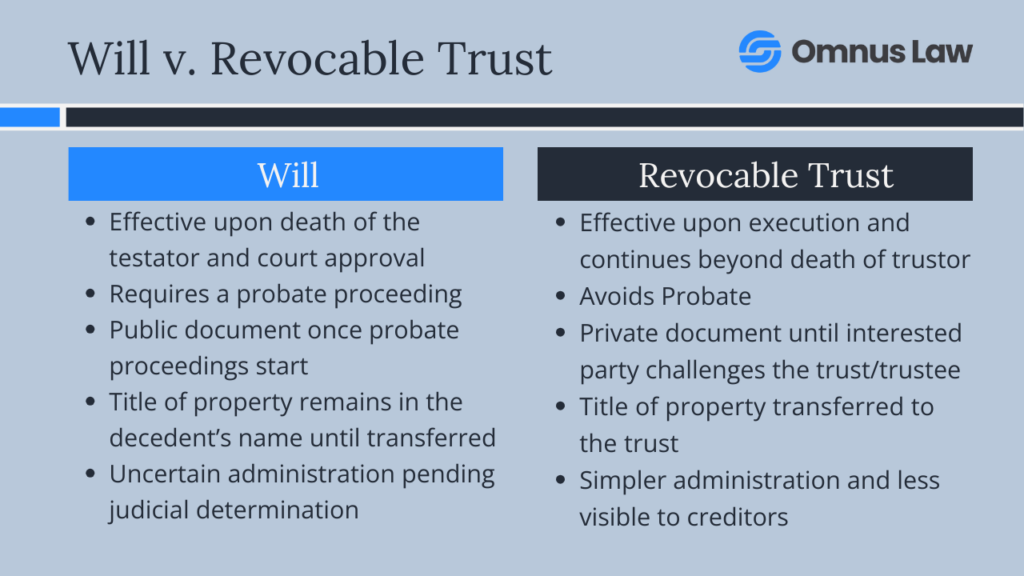

A will is a legal document that outlines your wishes for asset distribution after your death. It only becomes effective upon your passing and is subject to the probate process, where a court oversees the distribution of assets, ensures debts and taxes are settled, and resolves any disputes.

Key Features of a Will

- Activation Upon Death: A will takes effect only after the testator (the person creating the will) passes away. Probate court validates the will and supervises the asset distribution process.

- Public Record: Once probate begins, the will becomes public. This transparency can be beneficial for clear communication but may also expose private details to creditors or third parties.

- Probate Requirement: Probate provides a structured process and court oversight, which can clarify issues in complex or disputed estates but may also be time-consuming and expensive.

- Ease for Simple Estates: Wills are often suitable for straightforward estates where a direct transfer of assets is preferred without the need for extensive legal arrangements.

Advantages of a Will

- Simple and relatively straightforward to create.

- Allows for the designation of guardians for minor children.

- Clearly delineates specific asset distributions to named beneficiaries.

While wills offer clarity and simplicity, they do have limitations regarding privacy and probate requirements. For those seeking more control and protection, a trust may provide additional advantages.

What is a Trust?

A trust is a legal arrangement that allows for the management and transfer of assets, starting immediately upon signing. With a trust, assets are transferred into the trust and managed by a trustee on behalf of beneficiaries. Trusts can be revocable, allowing changes during your lifetime, or irrevocable, which cannot be altered once established.

Key Features of a Revocable Trust

- Avoidance of Probate: One of the main benefits of a trust is that it bypasses probate, enabling a direct and efficient transfer of assets to beneficiaries without court intervention.

- Privacy and Confidentiality: Unlike wills, trusts remain private documents, keeping sensitive details like asset value and beneficiary identities confidential.

- Immediate Control of Assets: Trusts provide beneficiaries with access to assets without waiting for probate, a valuable feature in situations requiring immediate funds.

- Asset Protection: Certain types of trusts offer protection from creditors, helping to preserve assets for future generations.

Advantages of a Trust

- Efficient Asset Transfer: With no probate requirement, trusts enable a quicker and often more cost-effective asset distribution process.

- Enhanced Privacy: Trusts keep asset details private, protecting sensitive information from becoming public.

- Control and Flexibility: Trusts allow you to define when and how beneficiaries receive assets, which is especially useful for younger or special-needs beneficiaries.

- Potential Tax Benefits: Certain trusts offer tax advantages that can reduce the financial burden on your estate and beneficiaries.

These distinctions highlight why some families may benefit more from a trust, while others find that a will alone is sufficient for their estate planning needs.

When to Use a Will

A will may be the best choice if:

- You Have Minor Children: A will enables you to appoint guardians for minor children, ensuring they are cared for by someone you trust.

- Your Estate is Straightforward: For smaller or simpler estates, a will is often more cost-effective and straightforward.

- You Want Court Oversight: The probate process can be beneficial for clarifying complex or contested estates and for overseeing the distribution of assets according to your wishes.

When to Consider a Trust

A trust may be more suitable if:

- Privacy is a Priority: Trusts keep your asset distribution private, which is valuable for those with substantial assets or privacy concerns.

- You Want to Avoid Probate: Trusts enable assets to transfer smoothly to beneficiaries, bypassing probate and the associated delays and expenses.

- You Want Greater Control Over Asset Management: Trusts allow you to distribute assets over time, which is especially useful for younger beneficiaries or those with unique needs.

- Tax Benefits are Important: Certain trusts provide tax advantages that can reduce the financial burden on your estate and beneficiaries.

Combining Wills and Trusts for Comprehensive Planning

Many people choose to use a will and trust together as part of a comprehensive estate plan. For example, a pour-over will can serve as a safety net, transferring any assets not already included in the trust at the time of death. This combination offers flexibility and provides the structured management and privacy of a trust, ensuring that all assets are protected and distributed according to your wishes.

Conclusion

Securing your family’s future and preserving your legacy are within reach with a well-thought-out estate plan. By understanding the distinct benefits of wills and trusts, you can make the best choices to meet your goals and protect your loved ones. At Omnus Law, we are committed to guiding you through each step, whether you seek the straightforward protection of a will or the enhanced privacy and flexibility of a trust.

As a Trust & Estates Lawyer, I am dedicated to providing tailored guidance that aligns with your wishes, so you can rest assured that your assets and family are in good hands. Contact me directly at karlen@omnuslaw.com to explore how wills and trusts can work together to build a strong, lasting foundation for those you care about most.